Back to Fort Fairfield Journal WFFJ-TV Contact Us

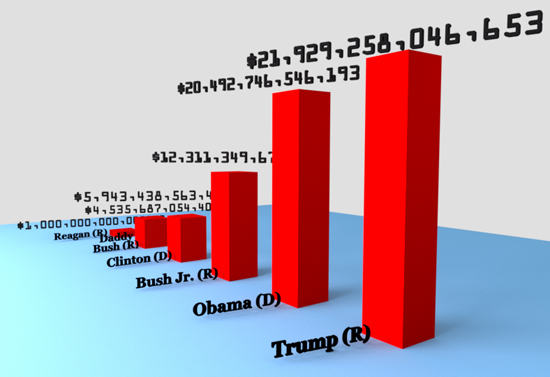

Republicans Push National Debt to $22 Trillion

3D graphic/David Deschesne

By: David Deschesne

Fort Fairfield Journal, January 16, 2019

While Republicans have been traditionally considered “conservative” in nature, there’s nothing conservative about the spending and debt levels going on in the District of Columbia over the past two years with a Republican-controlled Congress and Republican President.

According to treasurydirect.gov, the current U.S. national debt stands at just shy of $22 trillion. That translates to a personal debt of around $68,750 for every man, woman and child in the United States today, regardless of their income level. Whether the parents have good-paying jobs, or are at poverty level collecting welfare benefits, is irrelevant; the debt is owed by everyone equally. The total national debt liability for an average family of two parents and two children stands at $275,000 and this does not count State or local debt they are also on the hook for.

It took the United States 210 years to accrue its first $1 trillion in debt, which occurred in the mid-1980s under Republican President, Ronald Reagan. His successor, President Bush (the daddy) then oversaw the quadrupling of that amount in just four years’ time, ending his presidency with the U.S. $4.5 trillion in debt. This amounted to around $870 billion per year in new debt.

Debt growth slowed under Democrat, Bill Clinton, only increasing to $5.94 trillion by the end of his second term, or a rate over eight years of just $176 billion per year. To be fair, Reagan was overseeing the end of the “Cold War” with the former Soviet Union which saw ballooning budgets for war material. Daddy Bush also waged a contrived “war” and subsequent military policing presence in Iraq which required massive amounts of new money, as well.

When President Bush Jr., a Republican, took over the Presidency he and the Congress at that time speeded up the borrowing and spending yet again, this time with Gulf War II and the post-911 USA PATRIOT Act police state mandates which all required massive amounts of new money. Bush Jr. ended his two terms with the U.S. $12.311 trillion in debt, an increase of $6.37 trillion, which equates to around $790 billion per year of new debt during his eight year presidency, nearly pacing his daddy.

Then the U.S. suffered an even greater expansion of its debt load under Democrat presidential impersonator, Barrack Hussein-Obama who oversaw an increase of $8.18 trillion—a pace of just over $1 trillion per year in new debt.

Remember, it took 210 years to accrue the first trillion in debt. The Obama regime became the first administration to exceeded $1 trillion per year in new debt for the first time in United States history.

Now comes President Donald Trump who, after his first two years in office with a Republican Congress, continued the debt increasing pace by around $700 billion per year. For his next two years in office, Trump will be blessed with a Republican controlled Senate, but a Democrat-controlled House. Given past practice, it is expected the debt will continue to increase at the same rate or greater in the foreseeable future regardless of which party is in power.

It is important to note at this point, that while the President in power is the most recognizable figurehead for the U.S. government at any given time, all spending bills originate with the U.S. House of Representatives before making their way through Congress and ultimately authorized by the President when signed into law. Ergo, while the President—Republican or Democrat—shares part of the blame for the debt problems in the U.S. the blame must start with—and be granted a greater proportion to—members of the U.S. House of Representatives.

It is a little known fact to most Americans, outside of the readership of the Fort Fairfield Journal, that the reason for the rapid increase in the rate of growth of the U.S. National Debt is due to Congress surrendering its ability to coin money and regulate its value to a private, run for profit banking syndicate covertly named, “The Federal Reserve.” The Federal Reserve purchases printed money (“Federal Reserve Notes”) from the Bureau of Engraving and Printing for the cost to print them, then loans them back to the U.S. government at full face value, plus interest. In order for the United States to even have circulating currency, all money must be borrowed into existence before it can be spent into circulation. While all money (debt certificates) is actually bits and pieces of the loans of other peoples’ borrowed money, the vast bulk of newly created and borrowed money comes through the issuance of Treasury Bills, which are bought up by investors, foreign countries and—as of late—the Federal Reserve Bank. These treasury bills are all debts against the American people, whose “full faith and credit” back the payment of those loans. What this really means is that all personal and business property in the U.S.; all natural resources; all money in savings and circulation; and all future expenditure of human labor has been pledged by Congress to back the loans it takes out. The Federal Reserve, being the primary holder of those notes—then issues the nation’s money, charges interest on it while it’s in circulation and collects the interest payments in yet more borrowed money.

This mechanism of what is called “Fractional Reserve Banking,” where old loans are discharged with new loans, is functionally the same as paying off one credit card and its interest with a new credit card. The card may remain current, but the debt continues to perpetually increase. This is the situation the U.S. Congress has placed the American people in with relation to the debt owed to the private, run-for-profit Federal Reserve bank.

The so-called Federal Reserve was created by an act of Congress in 1913. The bank is not a branch of the U.S. government and does not have to answer to Congress or the President. The law establishing that private bank as the generator and controller of the U.S. money system was passed by only a few members of the Democrat controlled Congress while most members had already gone home for Christmas break. It was subsequently signed into law by Democrat President, Woodrow Wilson.

In order to keep a check against the money supply increasing out of control, Wilson also signed the illegal Federal Income Tax into law in 1916. The Federal Income Tax is essentially the loan collections arm of the Federal Reserve.

For its first twenty years in existence, the Federal Reserve loaned out Federal Reserve Notes to government, farmers, businesses, etc. at interest which was payable in gold—the money in circulation at the time. In effect, the Federal Reserve was working a ponzi scheme, with the complete acquiescence and approval of all future Congresses, by loaning pieces of paper with ink into circulation and demanding payment in real gold. By 1933 the amount of gold in circulation in the U.S. had dropped rapidly since the Federal Reserve was collecting all of it up in payments for its paper loan certificates.

When the American people figured out there was not enough gold in circulation, or in the banks, to redeem their paper money, there was a run on the banks to claim their gold.

Democrat President, Franklin D. Roosevelt then declared a “bank holiday”, shut down all banks in the country and reopened them three days later after Congress passed House Joint Resolution 192 (not a law) that made the use of gold as money “against public policy” and elevated the private Federal Reserve Note loan certificates to the status of “legal tender for all debts public and private.”

Fast forward to today where those debt certificates have been circulating for over eighty years, with the old loans they represented being discharged with newly borrowed money (like the credit card scheme previously mentioned), it is easy to understand how the national debt has gotten to be as large as it is and increasing at the logarithmic rate we are experiencing today.

The debt will continue to increase so long as the Federal Reserve chooses to continue purchasing Treasury bills with newly created money that is loaned into existence (most private investors and foreign countries have been shying away from T-Bills over the past decade or so). A point in time will come when the net assets of the U.S. people (all their property, natural resources, etc.) will not be enough to back any future loans. The Federal Reserve will then call in their notes by collecting that collateral and liquidating it. When a normal bank does this it repossess the car, boat or home that was pledged as collateral. However, when a national bank which has loaned money to governments does it, the government is overrun, usually by military force, and the bank puts its own people in power and control over the citizenry, their property and resources as an unelected dictator who then divides up the property and the labor of the nations’ economic slaves to the owners of the debt.

Former Democrat President John F. Kennedy attempted to put an end to this ponzi scheme in the 1960s by issuing United States Notes directly from the government for the government to spend for its projects—thus bypassing the Federal Reserve’s loans—Kennedy was subsequently summarily executed in broad daylight in front of thousands of witnesses, with his death blamed on the patsy, Lee Harvey Oswald.

More recently, former Congressman Ron Paul (R-Texas) attempted to get legislation through Congress to abolish the private Federal Reserve Bank and return the power over the U.S. money supply back to Congress. However, that attempt was curiously met with strong resistance from the establishment Republicans and Democrats in Congress and has gotten absolutely nowhere.

Where and when this debt party ends nobody really knows. But it will end, and the effects will not be pleasant.